Discover the power of Payment Orchestration and unlock hidden revenue streams by optimizing your online payment strategy. Learn how to easily expand into new markets, increase authorization rates, and improve your customer's checkout experience, all while saving on processing fees. With our comprehensive guide, you'll understand the benefits, implementation process, and architectures for both one-time and recurring payments. Don't leave money on the table – elevate your payment game with a tailored orchestration strategy that grows your revenue and cuts costs.

How to Implement a Payment Orchestration Strategy to Cut Costs and Grow Revenue

The past few years have been hard on businesses – full stop. Organizations everywhere are in a state where cash is king, and savvy institutions are taking decisive action to mitigate their risk and optimize their bottom line.

If you're selling products online, I would imagine that you’re thinking about how to continue driving growth while optimizing your costs and chances are, you've heard of Payment Orchestration – but what does it actually mean, how is it useful, what are the benefits and how difficult is it (really) to implement?

What is It?

In a nutshell, Payment Orchestration means being strategic about how money is flowing from your customers into your bank account and optimizing the pathway that money takes to get there. Why does this matter? Because by being strategic in choosing which processors are touching the funds, you can unlock a hidden (and lucrative) source of revenue.

If you’re a fan of the 1999 Cult Classic, Office Space, you already know how even a ‘fraction of a penny’ can add up to extraordinary sums of money over many transactions – apply this same logic to how adding Payment Orchestration to your payments strategy can help optimize your bottom line and unlock an otherwise hidden revenue stream. Once you implement a robust orchestration strategy, you will be optimizing the basis points (bips) spent on every payment that goes through your system.

What Are the Benefits?

When you choose which processor shuttles the payments, you can:

- Easily expand into new geographies

- Increase authorization rates

- Prevent incorrectly declined payments

- Protect your customer's checkout experience

- Give yourself leverage when negotiating rates with your payment providers

Having a payment orchestration strategy means that when one of your customers makes an online payment, you decide which payment service provider (PSP) processes it.

You can choose the processor based on a number of factors. Common ones are:

Global Access

- Many processors are not worldwide. Having integrations into multiple processors means that you can have one PSP processing payments in North America, another in Europe, another in Asia, and so on… The limitations on where your customers can live, which currency they can use and the payment instruments you can accept are a thing of the past.

- At VGS, we have seen this strategy be particularly effective when expanding throughout the South American and European markets, as many of the countries in these locations have processors that get lower rates for payments within their borders.

Interchange Rate

- Many processors give discounts based on the type of card used to pay. For example, one PSP may have additional costs to process a transaction with a digital ApplePay card, but another PSP processes the payment without any additional fees. Since you have given yourself a choice of processors through your payments orchestration strategy, you can choose the latter, and optimize your payment processing costs. As your organization begins accepting more payments online, these hidden costs begin to be substantial.

- VGS has helped our enterprise customers save millions of dollars per year simply by being explicit about how different card and wallet brands are funneled to different processors.

Automatic Retries

- All too often, the customer checks out online, but a random failure in the transaction means they can’t buy their items. That means you are left without a payment and the risk of the customer not attempting to purchase again. Having multiple processors in your orchestration strategy means that if the payment fails with one, the payment gets tried automatically with the next one. Your customer gets a seamless checkout experience and you have increased the chance of them being a repeat buyer. The intermittent failure from one of your PSPs no longer poses any risk to your business.

- Random failures in a transaction are commonly known as soft declines in the payments industry. These are transactions that one processor may choose to decline, while another processor will process. Soft declines account for 80-90% of all declines for online transactions. This means that simply by using VGS to implement secondary processors, our customers have drastically increased their approval rate.

What are the costs of only using a single processor?

Although the benefits are clear, we haven’t talked about the costs yet. You may well ask - what about the development time required to add in new payment processors? What kind of cost savings are companies seeing by implementing a strategy like this?

Glad you asked. VGS has helped large enterprises save millions of dollars a year in processing fees by implementing an intelligent and well-thought out payment orchestration strategy.

How do I implement a payment orchestration strategy?

Implementing a payment orchestration strategy with VGS can be broken down into a few simple steps:

- Determine your payment needs: Before implementing a payment orchestration strategy, it's important to know what payment methods you need to support and what payment processors are available in the markets where you operate. This will help you choose the right processors for your business and optimize your payment costs. It is also important to consider whether or not you will need to support recurring payments or one-time payments. For more details on the different main types of orchestration models, see the “What payment orchestration architectures should I consider?” section below.

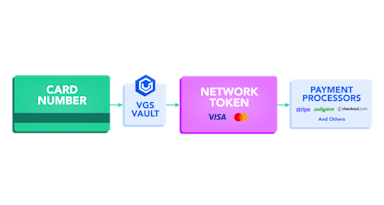

- Collect and tokenize card data: In order to securely process payments, it's important to collect and store card data in a way that minimizes your business's PCI compliance requirements. VGS offers tokenization services that allow you to collect sensitive payment information from customers without ever touching it directly, reducing your risk of data breaches and simplifying your compliance efforts. This payment information can then be used to post `transactions to any payment processors you choose.

- Choose your payment processors:VGS offers pre-configured integrations with many popular payment processors, such as Stripe, Adyen, and Cybersource, or you can add your own custom integrations using VGS's easy-to-use tools. Choose the processors that offer the best rates and features for your business needs. Configure your payment routing rules: Once you have your payment processors set up, you'll need to design your payment routing rules. These rules determine which payment processor handles each transaction based on factors like the customer's location, the payment amount, the type of card, whether or not the payment is made from Apple or Google Pay, and other factors that are important to your business. You will also want to decide the rules for retrying failed payments so that your customer checkout process is not disturbed by soft declines from one processor.

- Test and refine: After you've configured your payment routing rules, it's important to test them thoroughly to make sure they're working as expected. This may involve running test transactions through your system and tweaking your rules to optimize your results.

- Monitor and adjust: Payment processing is an ever-evolving landscape, and it's important to monitor your payment processing performance regularly to identify any issues or opportunities for improvement. With VGS, you can easily monitor your payment processing metrics and make adjustments as needed to optimize your revenue and minimize your costs.

What payment orchestration architectures should I consider?

When implementing a payment orchestration strategy, there are two main models to consider: one for recurring payments and another for one-time payments. The choice of which model to implement will depend on the business model and payment needs of your organization. For example, a subscription-based service may benefit from the recurring payment model, while a retail store may opt for the one-time payment model. In either case, implementing a payment orchestration strategy can provide significant cost savings and revenue growth opportunities for businesses of all sizes.

Recurring Payments

Recurring payments, also known as card-on-file payments, are a popular payment model for businesses that want to collect card information from their customers one time but allow for the card to be used multiple times. This can be useful for a variety of business-cases, such as:

- Scheduled payments, such as for streaming service subscriptions or utility bill payments.

- Online merchants and marketplaces who want to let customers store cards for future payments.

- Businesses who want to develop an omni-channel loyalty program to help unify the customer experience for online and in-person transactions. Check out the Fivestars Case Study if you are interested to find out how VGS has helped provide incredible omni-channel customer experiences.

One approach to enabling recurring payments is to use the PAN and CVV collected from the user to generate PSP-specific recurring payment tokens. Merchants can acquire these PSP-specific tokens by using a tokenization provider like VGS to collect the PAN and CVV and then process a $0 authorization to each of the PSPs that will be used to process payments in the future. After the initial $0 authorizations, the merchant can use the PSP-specific tokens for all future payments to the PSPs. With this model, the tokenization service only needs to be used for the initial $0 authorization request, and all other payments can be sent directly to the PSPs.

One-time Payments

A one-time payment is a transaction where the customer pays for a product or service only once, and their payment information is not stored for future use. To do this, customers typically need to provide their payment information, such as a credit or debit card number, and authorize the payment for a specific amount. One-time payments are useful for customers who prefer to pay for products or services without committing to ongoing payments or subscriptions.

One-time payments can also be a useful tool for businesses that need to comply with data protection regulations, such as the General Data Protection Regulation (GDPR). By processing one-time payments instead of storing customer payment information, businesses can reduce their exposure to data breaches and maintain compliance with regulations.

Conclusion

Businesses can easily implement a payment orchestration strategy that meets their unique needs and unlock the full potential of their payment processing capabilities with the help of a trusted tokenization provider like VGS.

At VGS, we want you to be empowered to take control of your own payment destiny by partnering with any payment processor that meets your business goals. We have seen customers save millions of dollars every year by using one of our 50+ pre-configured integrations, or adding your own using the easy-to-use tools in the dashboard.

Don’t wait to use your payments to save. Reach out to us today and speak with a team that specializes in creating payment strategies for enterprise-grade clients like you.