BLOG

What's New in PCI DSS 4.0?

Read NowSolving PCI Compliance

Whether you need to maintain and expand payments infrastructure without expanding your PCI footprint, are scaling your payments technology stack across businesses, or setting up a new business that requires PCI certification, VGS can help.

Achieve updated requirements such as PCI DSS v4.0 or become PCI Compliant for the first time. The VGS Vault enables you to scale securely and rapidly with the freedom to operate on sensitive payment data without ever touching it.

Contact Us

GROW FASTER

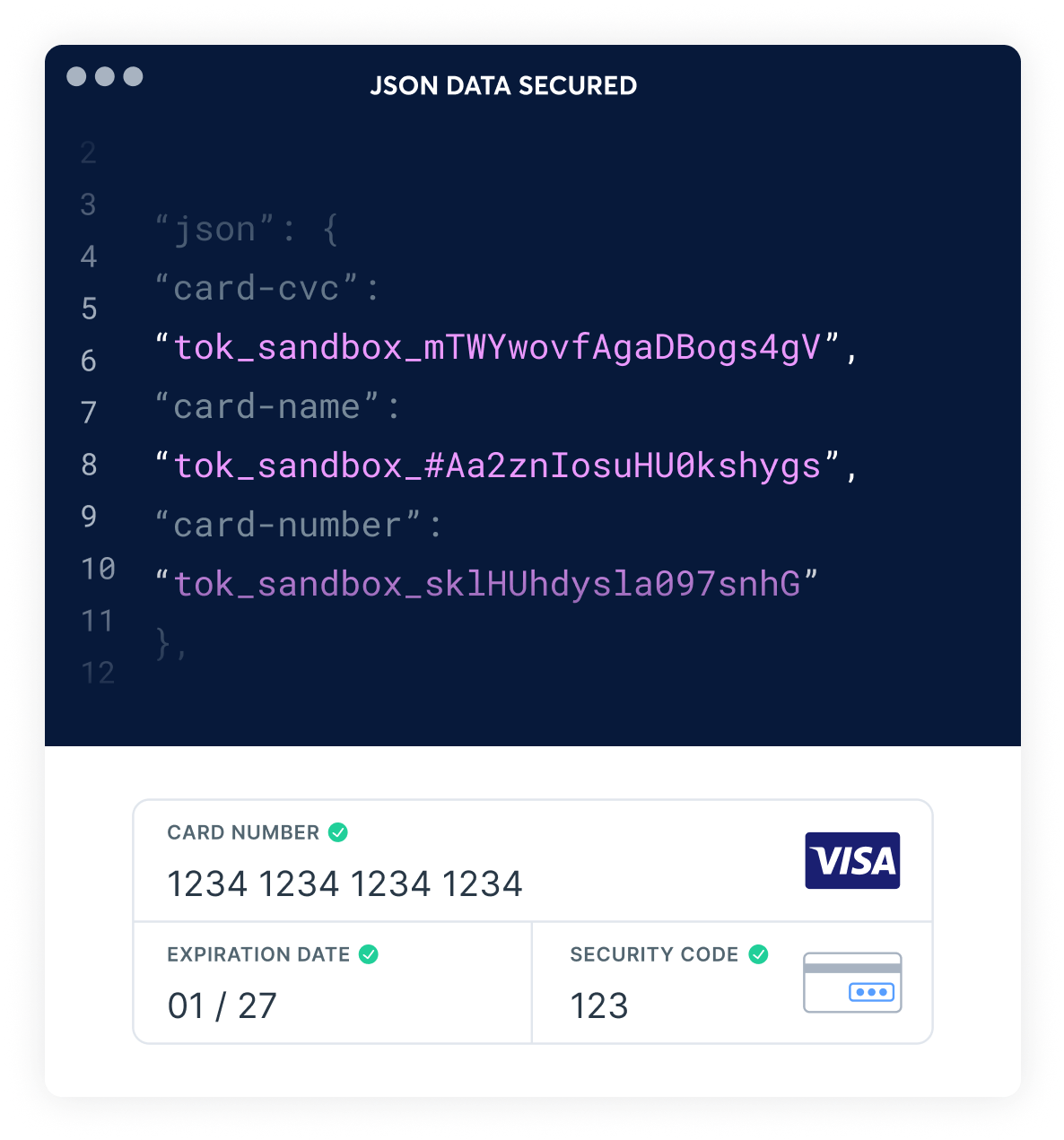

Your dedicated VGS Vault allows you to work with a broad array of payment data and not be in scope for PCI Compliance. With VGS, you can safely collect, protect, and send payment data to third-party endpoints by swapping out raw sensitive information with our secure tokens.

MEET NEW REQUIREMENTS

PCI DSS v 4.0 will be the industry standard from 2024 onward.

Effective March 31, 2024 PCI DSS v3.2.1 will be retired, and PCI DSS v4.0 will be the new PCI standard. QSAs have already switched to conducting new PCI level 1 assessments against PCI DSS v4.0.

On March 31, 2025, all the PCI DSS v4.0 future-dated requirements will become mandatory.

Companies must update their processes, procedures, and technology to ensure that they not only set up PCI-compliant Cardholder Data Environments (CDE) and maintain them annually, but also meet the updated new requirements.

Read more here: What's New in PCI DSS 4.0?

Any organization that deals with Credit or Debit cardholder data.

if you,

Sensitive Credit or Debit card data, you are subject to PCI DSS 4.0 requirements.

In other words, your cardholder data environment (CDE) is in “in-scope,” and you are subject to its guidelines.

How it Works

As the leading PCI Tokenization Provider, our platform enables companies to seamlessly operate on sensitive payment data without ever touching it. The VGS Solution shields you from sensitive data by substituting sensitive, raw payment data with non-relational tokens or aliases (a form of synthetic data) in real time. VGS operates at the network level, so your systems never come into contact with sensitive data. You stay entirely protected without any architecture changes or the need to integrate a separate API - freeing your organization to focus on growing your business rather than the liability of protecting it.

Get Continuous PCI Compliance Service Maintain continuous PCI compliance with VGS's dedicated full-time resources building a secure network, protecting cardholder data, enforcing information security policies, and more.

Start Descoping Now

Achieving PCI Level 1 on your own often takes 6-12 months, or longer, on top of recurring annual PCI security maintenance and audits. Reaching Level 1 requires dedicated full-time resources to build and maintain a secure network, protect cardholder data, uphold a vulnerability management program, implement strong access control, monitor and test networks, and enforce an information security policy.

PCI Level 1 is achievable in just 21 days, no matter the type of business (merchant, service provider, or other). Integrate to VGS with no changes to existing systems, and instantly begin securing, managing and using sensitive data.