The Durbin 2.0 is designed to give merchants routing choices. To take advantage, merchants should focus on retaining control of card info while staying mindful of their PCI posture.

The Durbin Amendment 2023 has created buzz and confusion in the payments ecosystem. The changes it brings have the Debit landscape shifting beneath our feet, especially for merchant acceptance. Let’s unpack its impact on digital payments (card not present) and the significant role that Network Tokens could play in this new era.

The History of the Durbin Amendment

Before we get to the revised version in 2023, let’s quickly recap what happened with the Durbin Amendment 2010 (“Durbin 2010”). As a part of the Dodd–Frank financial reform legislation in the wake of the 2008-09 recession, Durbin 2010 aimed to lower merchant costs and pass some savings on to consumers to spur economic activity.

With Durbin 2010, The Federal Reserve passed two significant changes:

- Reduced Interchange Fees: The interchange fees on debit card transactions were capped to reduce merchants' processing costs. The debit interchange fee cap applied to larger financial institutions with over $10B in assets.

- Enabled Network Optionality: Issuers were required to offer the option to route debit card transactions over unaffiliated payment networks. However, at the time, there weren’t many solutions supporting this for Card-Not-Present (CNP) transactions, so many issuers did not enable this option for CNP transactions.

Durbin 2.0 (Durbin Amendment 2023)

The payment landscape has changed dramatically in the 12 years since the Amendment went live. The advent of Chip-and-Pin, the proliferation of mobile wallets, and the rise of eCommerce as an $8T behemoth by January 2026 - are all developments from the last decade.

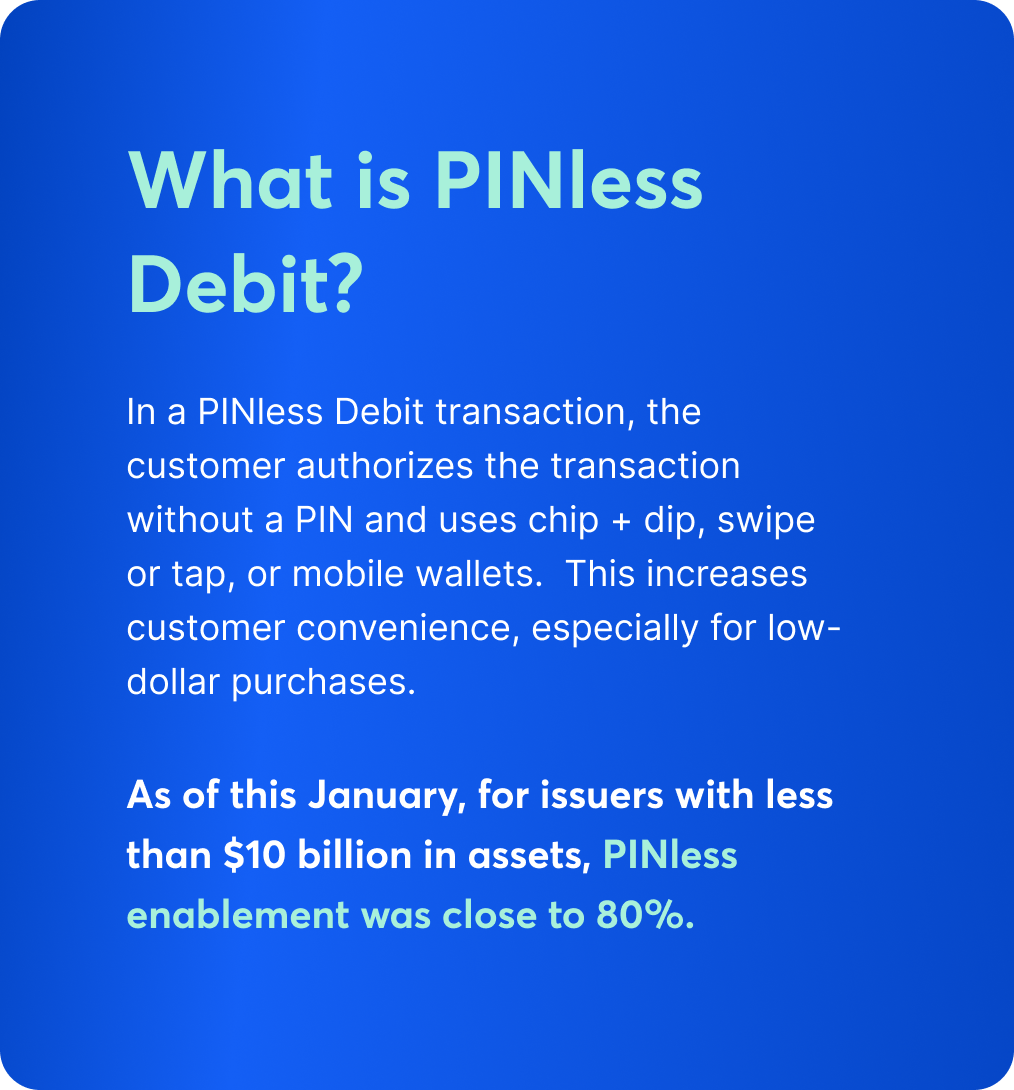

The 2023 Revision takes note of these changes by regulating online and PINless debit transactions. This expands the scope of the original Amendment in 2011, which primarily addressed in-person transactions on standard debit cards.

- Wider Scope: The Amendment includes CNP (Card-Not-Present) transactions, which are primarily PINless and occur online.

- Broader Network Optionality: Issuing banks now must ensure that all debit transactions, including those occurring in card-not-present situations that are typically PINless, are compatible with at least two independent and unaffiliated networks. Issuers are required to enable this capability for each type of transaction everywhere the issuer’s debit card can be used. In other words, issuers must ensure at least two independent and unaffiliated networks are compatible with CNP and CP (Card-Present) transactions.

Considerations for Merchants

With issuers expected to ensure support for a minimum of 2 unaffiliated networks, it is a good time for merchants to assess how they can maximize performance and efficiencies when processing Debit transactions.

However, merchants must be aware of key considerations if they want to refresh their Debit processing strategy:

- Do merchants have their customer card numbers (PANs)?

Merchants often delegate debit routing responsibilities to their acquirer processors or Payment Service Providers (PSPs). While this approach offers convenience and efficiency, it may create unintended consequences. With this arrangement, merchants typically surrender control over their Primary Account Numbers (PANs). Without control of the PANs, merchants are often in the dark about which unaffiliated networks are associated with a card. Consequently, merchants may be restricted if they wish to explore alternative processing solutions for better pricing. If you are a merchant who follows this practice, it may be time for you to review your invoices from your acquirer or PSPs and assess the cost implications associated with debit routing. - When merchants do have PANs, can they safely store and leverage them for Pinless routing?

Just ownership of PANs isn’t enough - merchants must also secure these in a PCI-compliant way. Most merchants don’t want the initial burden or the annual maintenance of managing their own PCI-compliant vault. At the same time, merchants who have PANs also need to be able to check the corresponding unaffiliated networks associated with a given card to decide their routing strategy.

As the world’s largest cloud-based tokenization platform, VGS is well aware of these challenges. Our customers want utility from their data, be it for processing optimization, loyalty programs, or something else, but don’t want to take on the liability of it. Partnering with VGS on a universal token vault can help achieve data utility without liability.

Now that you know about the expansion of Durbin 2.0 to CNP PINless transactions, are you curious to learn more about optimizing your payment strategy for this fast-growing area? Tune in next week to learn how to route (or not) PINless transactions with Network Tokens. If you’d like to get a quick understanding now of how Network Tokens work, read more here.