In our last blog on Video Gaming, we reviewed the eye-popping growth and payment trends specific to this industry.

Next, let's look at how changing needs and compelling events, coupled with the historical interaction with the financial services industry, will drive what Video Gaming needs from their payment infrastructure in the future.

Maturing Needs

As the number of users grows to add to an already massive base, gaming companies need a centralized hub for storing sensitive payment information. The strong global user and transaction amount growth rate results in large payment volumes and the need to support even more global payment types. This growth creates the need to secure large amounts of payment data while ensuring operational efficiency.

As they mature, video gaming companies are asking the questions any merchant selling large volumes should ask:

- How can I secure my users' sensitive data?

- What utility can I get from my data to grow even more?

- Can I lower my fees while I grow?

And more.

Historical Context

Banks and Video Gaming companies are still figuring out how to work together. Historically, this vertical has been misunderstood by the financial services industry/banks and networks as being gambling instead of gaming. This has sometimes led to incorrect merchant categorization with MCCs and overly strict banking risk/fraud models, penalizing them with higher processing fees and lower acceptance rates.

Banks have also hesitated to associate too closely with gaming due to the (sometimes misunderstood) brand risk - associating all video games with violence and/or gambling, where many are in the relatively benign and very popular territory of Pac-Man, Super Mario, Spiderman, or similar.6

Future Compelling Events

Going forward, a Multi-Billion vertical deserves a closer look, especially given a few compelling events.

Industry Deadline for Security Updates

A new PCI-DSS standard will be upon us within this first quarter of 2024.

In March 2022, the PCI Security Council released the new Payment Card Industry Data Security Standard (PCI DSS) v4.0. They set March 31, 2024, as the deadline to retire PCI DSS v3.

Now, besides the usual requirement of setting up a PCI-compliant environment (which typically takes months) and then maintaining it annually, companies who choose to manage sensitive data on their own need to make sure they adhere to the updated requirements of PCI 4.0 as well. Just a few of these include expanded multi-factor authentication and updated password requirements, deeper alignment on the substantial information reported in a Self-Assessment Questionnaire, and matching the information summarized in an Attestation of Compliance.

Need for Global Payouts

The trends of solopreneurship and the gig economy have also made inroads in the gaming world. In particular, mobile game development and content creation have been democratized beyond corporations, and developer shops are on the rise.

When game developers develop games on their own on massive platforms such as Unity that provide development tools (and power 71 of the top 100 mobile games), they can do so being based anywhere. This means they have a wide variety of payment acceptance needs - which gaming companies and their processors need to support globally.

Like the developers, many artistic creators (who create gaming assets, visuals, character skins, and more) may also work independently. Gaming companies must accommodate all these payouts across payment types, currencies, and regions to win with the best talent.

Supporting our Gaming Customers

Centralized PCI-compliant vault

- Our current Gaming customers started off managing their payment infrastructure on their own. But as they grew, they needed to expand to multiple payment processor connections and fraud providers - while still being vulnerable to data breaches due to the sensitive data on their systems. Even when their data was secure, managing and maintaining PCI compliance annually still meant time away from their core gaming business.

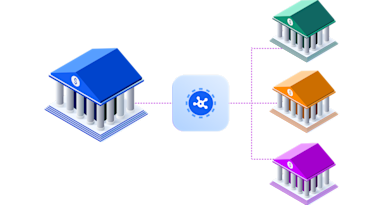

- VGS enabled them with a PCI-compliant centralized payments hub that solved both issues. All their data in one place resulted in optimizing their operational costs and inefficiencies, while tokenization secured them from malicious hacks.

- Our customers wanted control over their data to decide when and how to orchestrate their payments across processors. With a universal Vault, VGS supplemented their infrastructure with flexible capabilities that worked with their payment logic so they could set up and control their own subscription and payment logic, instead of being subject to the limitations of their providers.

Add the Ability to Work with a Diverse Set of Global Providers

- We have observed that when gaming companies set up processing independently, they invest their resources in a single processor. This leaves them open to unsuccessful payments when the processor fails. A single-processor setup also gives them less pricing leverage than when working with multiple processors.

- Adding a processor-agnostic Vault provider like VGS to their payments stack can solve this. For a sizeable social gaming company in the US, adding VGS meant achieving freedom in payment orchestration. Storing all the data in one place in their VGS Vault meant that they could orchestrate payments across Worldpay, Adyen, and other processors to achieve processor redundancy and increase their transaction success rate in each region they operated in.

Support for Multiple Game Types

Video games can be on mobile or gaming consoles or sold online through a game marketplace (e.g. Steam) on the PC. Games can work across multiple channels simultaneously, be tied to one channel like an Xbox physical console, or move from one channel to another by adapting their mobile game to become available on a Nintendo Switch physical console. These typically have different payment needs and underlying processors and can thus benefit from consolidation.

Enable a Marketplace Structure

A gaming ecosystem consists of the game publishers selling the games and other extras as digital assets, the platforms where these games are purchased (such as the Xbox Marketplace), and the gamers making these payments. A gaming marketplace needs the payment infrastructure to match. Any payment infrastructure offered across the ecosystem needs to enable all three, which calls for maximum payment flexibility and processing options. This is only possible when all the payment information is centralized and can be deployed as needed.

Video Gaming is a growing industry with a complex set of payment needs. Companies in this space would benefit from future-proofing with a robust payments infrastructure that gives them control over their data, power over their pricing, and protection from breaches.

Curious to learn more? Contact Us.