Increase authorization rates and reduce your costs with VGS Network Tokens

Using one Network Token across multiple processors boosts conversion and savings while reducing fraud

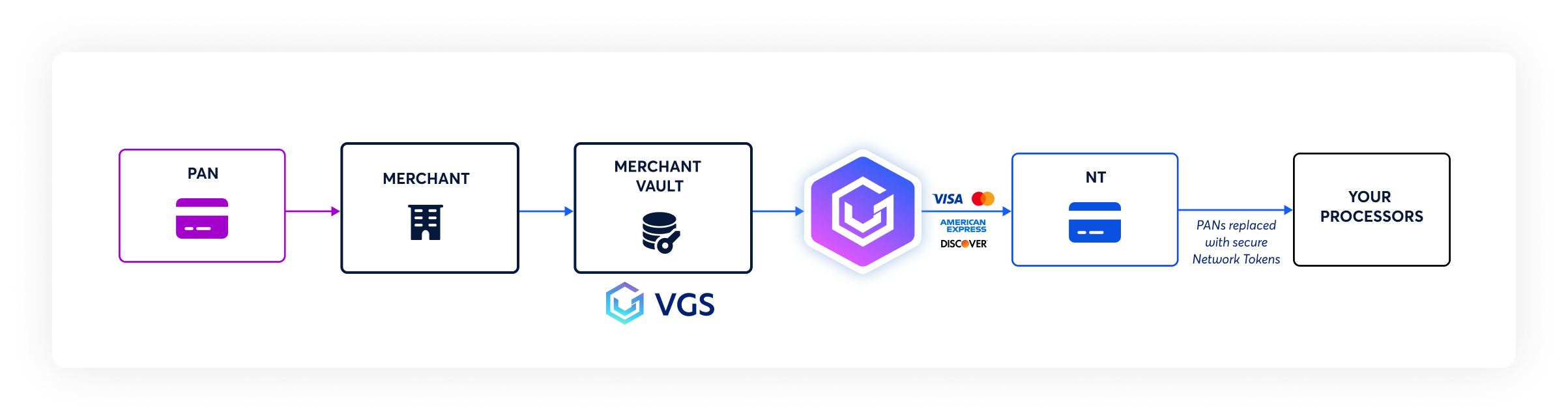

Network Tokens substitute card numbers with tokens. These are processor-agnostic, merchant-specific, and automatically updated when a card expires or changes.

VGS Network Tokens also work with processors that typically don't accept these.

HOW IT WORKS

VGS Network Tokens

VGS is one of the only tokenization platforms in the world to build a direct integration with Visa, Mastercard, American Express, and Discover to provide Network Tokens, keeping us competitive on both pricing and accuracy.

Does your processor not accept Network Tokens? VGS can still help. Find out how.

*May vary based on merchant, region, use case and others.

Enhance Your Checkout with Card Art

Card Art comes included with Network Tokens

- Ensure Accurate Card Selection

- Lower Chargeback and Disputes

- Speed Up Checkout Experience

VGS Network Tokens offer processor flexibility, stronger security and lower costs

You can enable Network Tokens quickly and cheaply by enrolling your cards with VGS.

Maximize Card Coverage

Not all cards will be Network Token provisioned. Best-in-class merchants ensure connectivity to the PAN for successful card lifecycle management. Add Account Updater to ensure there are no gaps in card coverage.

Learn More about Account Updater

Store and Enrich All Your Payment Data with a Single API Integration

Use a single card object across Network Tokens, Account Updater, and Card Attributes on our Card Management Platform.

Learn More about Card Management Platform

Ready to Get Started?

Use Network Tokens, and see the difference in your rates and costs when you work with just one token across processors.

Contact UsWhy do I need both Network Tokens and Account Updater?

Learn how by combining these ensures a robust payment infrastructure that increases authorization rates, reduces costs, maximizes coverage, and retains access to the PAN.

Read MoreFAQs

A network token is a set of secure, randomized code that acts as a substitute for a credit card's primary account number (PAN). Network tokens enable merchants to securely process payments without storing sensitive card details, thereby significantly reducing the risk of fraud and data breaches while enhancing security. These tokens are issued and managed by the major card networks themselves, such as Visa, Mastercard, American Express, and Discover.

PCI tokens are generated by a token service provider, like VGS, and used internally for storage and processing. Network tokens, on the other hand, are provisioned by the card networks themselves and can be used globally across merchants, acquirers, and issuers for transactions.

Network tokens improve payment security by reducing reliance on raw card data. They are automatically updated when a card is reissued or replaced, lowering declines due to expired or replaced cards.

Yes, because network tokens are not actual card numbers, they reduce PCI DSS scope. However, merchants must still maintain proper controls depending on their environment.

Yes. When a consumer's card is replaced (e.g., due to expiration, loss, or theft), the network updates the associated network token. This ensures continuity of recurring billing or subscription payments.

Network tokens can be used for most card-not-present transactions, such as e-commerce, subscriptions, and mobile wallets. However, acceptance may vary by issuer, acquirer, or region.

Yes. Some card networks incentivize the use of network tokens by offering reduced interchange fees or lower costs related to fraud. Additionally, fewer declined transactions mean less revenue loss.

A token service provider (TSP) is a secure technology company responsible for generating, issuing, and managing payment tokens. These tokens are unique digital identifiers that replace sensitive cardholder data, such as the Primary Account Number (PAN), during transactions.

Yes, VGS is one of the only PSP-agnostic token service providers. This independence allows merchants or enterprises to tokenize payment card data and manage tokens without being locked into a specific payment processing partner.