You have built your business by engaging customers wherever they are - on a laptop or mobile device or in a physical store. With e-commerce, customers worldwide can view your storefront to purchase and receive your products or services - all with a simple credit card. However, this openness to business also creates openness to potential fraud.

Protecting sensitive customer data, such as credit card information, is crucial when transacting online. Merchants like you who accept credit card payments must adhere to the Payment Card Industry Data Security Standard (PCI DSS v4) standards otherwise, you may face fines or even lose the ability to take card payments.

The latest standard iteration, PCI DSS 4, attempts to stay ahead of constantly evolving cybersecurity threats with new requirements. Adhering to these requirements poses a significant challenge. However, combining solutions from HUMAN Security - the leader in bot and fraud mitigation, and VGS - the world's leader in payments tokenization, makes navigating these intricate regulations easier for online merchants.

Figure 1: Simplifying PCI 4.0 compliance and streamlining customer online experience.

Understanding PCI DSS 4.0

To comply with PCI DSS 4, you must understand the requirements.

PCI DSS sets security standards for online payment transactions. Its primary goal is to ensure robust data protection for customers, merchants, and credit card providers and reduce the risk of breaches and fraud.

Some key updates in PCI DSS 4.0 include the following:

- Risk-based approach. Merchants must adopt a risk-based approach to security, which requires them to assess their security controls continuously and adapt as necessary.

- Encryption and tokenization. PCI DSS 4.0 emphasizes encryption and tokenization to protect stored data, reducing the scope of data exposure in the event of a breach.

- Understanding client-side scripts. Web pages and applications rely heavily on scripts, so a site owner must understand which scripts are running, what they are doing, and how to protect customer information on payment page scripts executed in the consumer's browser.

- Increased focus on continuous compliance. Merchants must demonstrate ongoing compliance rather than achieving it as a one-time task. This requires continuous monitoring, auditing, and reporting.

The compliance challenge for online merchants

For you, the online merchant, complying with PCI DSS 4.0 is a multifaceted challenge. Merchants need to do the following:

- Secure customer payment information, often stored or transmitted within different platforms.

- Implement encryption and tokenization protocols, which can be technically complex processes

- Monitor and audit client-side scripts and page headers to ensure continuous compliance.

- Deal with the rising threat of cyberattacks that target payment systems, such as scraping payment information with malicious scripts.

Navigating these complexities while ensuring a smooth customer experience is daunting. This is where VGS and HUMAN come in, providing complementary solutions that make PCI DSS 4.0 compliance more manageable.

HUMAN: Visibility and understanding of client-side scripts

HUMAN Client-side Defense makes it easy to comply with the new client-side script requirements, 6.4.3 and 11.6.1. The solution provides continuous monitoring and protection, ensuring merchants comply with PCI DSS 4's requirements for payment page browser script management.

How HUMAN Security works

With a single line of code, HUMAN helps organizations painlessly achieve and maintain compliance with browser script requirements by auto-inventorying scripts, capturing authorization and justification, and monitoring scripts and headers for behavioral integrity and indications of compromise:

Protect.

A single line of code will auto-discover, maintain, and detect changes to the script inventory, payment pages, and security-impacting HTTP headers. HUMAN provides a simple and automated method to authorize, justify, and assure the integrity of scripts (requirement 6.4.3). Beyond compliance, policy rules enable merchants to extend a zero-trust approach to payment data and other sensitive information in the browser, building invisible guardrails for developers without limiting their agility. HUMAN surgically blocks risky script actions based on those proactive policies without disrupting the value provided by vital scripts.

Detect.

HUMAN's sensor runs in every browser session, providing complete visibility into script behavior in real consumers' browsers. It detects modifications and indications of compromise and issues real-time high-risk alerts on changes to security-impacting HTTP headers and the script contents of payment pages (requirement 11.6.1). HUMAN's dashboards provide in-depth script analysis, including each script's provenance and document object model (or DOM), cookies, storage, and network actions. The risk of each script's actions, such as cardholder data access and risky-domain communication, can inform security, compliance, and business decisions.

Comply.

Dashboards, input fields, and reports all map directly to PCI DSS guidance and language, ensuring quick ramp up and alignment with PCI assessors. Policy rules enable merchants to automate script authorization at multiple levels of granularity (e.g., per vendor, first-party, script, script action, and more), simplifying management and saving significant amounts of time for security, compliance, and development teams. Audit reports are auto-generated and can be exported at-a-click to demonstrate continuous compliance with PCI DSS 4 to assessors.

The key benefits of using HUMAN to simplify PCI DSS 4 compliance

- Streamline payment page script and header management. HUMAN enables customers to simplify compliance tasks, painlessly protecting their payment pages in compliance with requirements 6.4.3 and 11.6.1 of PCI DSS 4.

- Secure your client-side beyond PCI DSS compliance. HUMAN gives customers complete visibility and control of script behavior in real consumers' browsers, real-time high-risk alerts, and in-depth script analysis.

- Enable your business to safely benefit from browser scripts. HUMAN allows customers to establish invisible guardrails around browser scripts, which minimize the risk of a cardholder data breach without disrupting scripts' functionality or limiting the agility of internal developers and marketers.

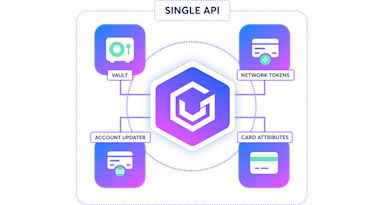

VGS: Simplifying data security and tokenization

VGS specializes in tokenization, encryption, and vaulting all sensitive data. It makes it significantly easier for merchants to handle sensitive data while complying with PCI DSS. VGS's approach is to help merchants reduce the scope of their PCI DSS compliance by offloading data security responsibilities.

Key benefits of VGS for PCI DSS 4.0 compliance

- PCI Compliance scope reduction. Since VGS handles the storage and security of sensitive information, merchants can significantly reduce the scope of their PCI DSS requirements. By not storing sensitive cardholder data themselves, merchants have fewer systems to secure and audit.

- Seamless integration. VGS is designed to integrate easily into existing business workflows without disrupting operations. Merchants can continue processing payments as usual, but with the added assurance that their sensitive data is being securely managed.

- Encryption and tokenization. VGS ensures that sensitive data is encrypted both in transit and at rest. By tokenizing data, VGS reduces the risk of breaches, as stolen tokens are useless to attackers.

- Continuous compliance. VGS provides continuous monitoring and auditing capabilities, allowing merchants to demonstrate ongoing compliance with PCI DSS 4.0.

VGS allows merchants to “offload” much of the complexity of storing and protecting cardholder data, making PCI DSS 4.0 compliance significantly more manageable.

The power of combining VGS and HUMAN

By combining the strengths of Very Good Security and HUMAN, online merchants can address both the data protection and client-side script requirements of PCI DSS 4.0.

VGS enables merchants to securely store and process payment data without handling sensitive information directly, reducing their compliance burden and protecting against data breaches. HUMAN detects, inventories, and monitors all the client-side scripts running to defend merchants against cyberattacks that target payment pages. This ensures that malicious activity is detected and stopped before it can compromise sensitive information.

Together, these solutions create a comprehensive compliance framework that addresses both the technical and security challenges of PCI DSS 4.0. By leveraging VGS's tokenization and data security capabilities alongside HUMAN script detection and monitoring, merchants can simplify achieving and maintaining PCI DSS 4 compliance while minimizing the risk of data breaches and fraud.

Conclusion

The evolving landscape of cybersecurity threats and the increasingly stringent requirements of PCI DSS 4.0 can be overwhelming for online merchants. However, by partnering with companies like VGS and HUMAN, merchants can streamline the process of complying with these complex standards. By offloading the responsibility of handling sensitive payment data to VGS and utilizing HUMAN's script detection and monitoring, merchants can easily achieve compliance and enhance the overall security of their online platforms. This powerful combination offers a clear path forward for merchants looking to thrive in a rapidly changing digital world.

To understand how HUMAN and VGS can enable you to comply with PCI DSS 4, check out more on HUMAN's approach to PCI DSS compliance and learn more about VGS's approach to sensitive data tokenization that ensures PCI DSS compliance.