It's with great excitement that VGS is officially launching VGS 3DS, designed to deliver stronger security, smoother checkout experiences, and greater flexibility for businesses and their customers.

As online transactions continue to grow, so do the risks of fraud and chargebacks. 3D Secure (3DS) adds an extra layer of protection by authenticating cardholders during online payments and is mandated and heavily regulated in many regions.

“With our new 3DS product, we're giving global businesses the best of both worlds: stronger protection against fraud and a frictionless experience for customers at checkout, “ says Matt Vanhouten, Senior Vice President and Head of Product at VGS. “We listened to what our customers wanted and needed.”

VGS's 3DS solution is built with performance and user experience at its core, helping businesses protect revenue without sacrificing conversion rates.

Read more on VGS's 3DS offering from our PR

Centralization

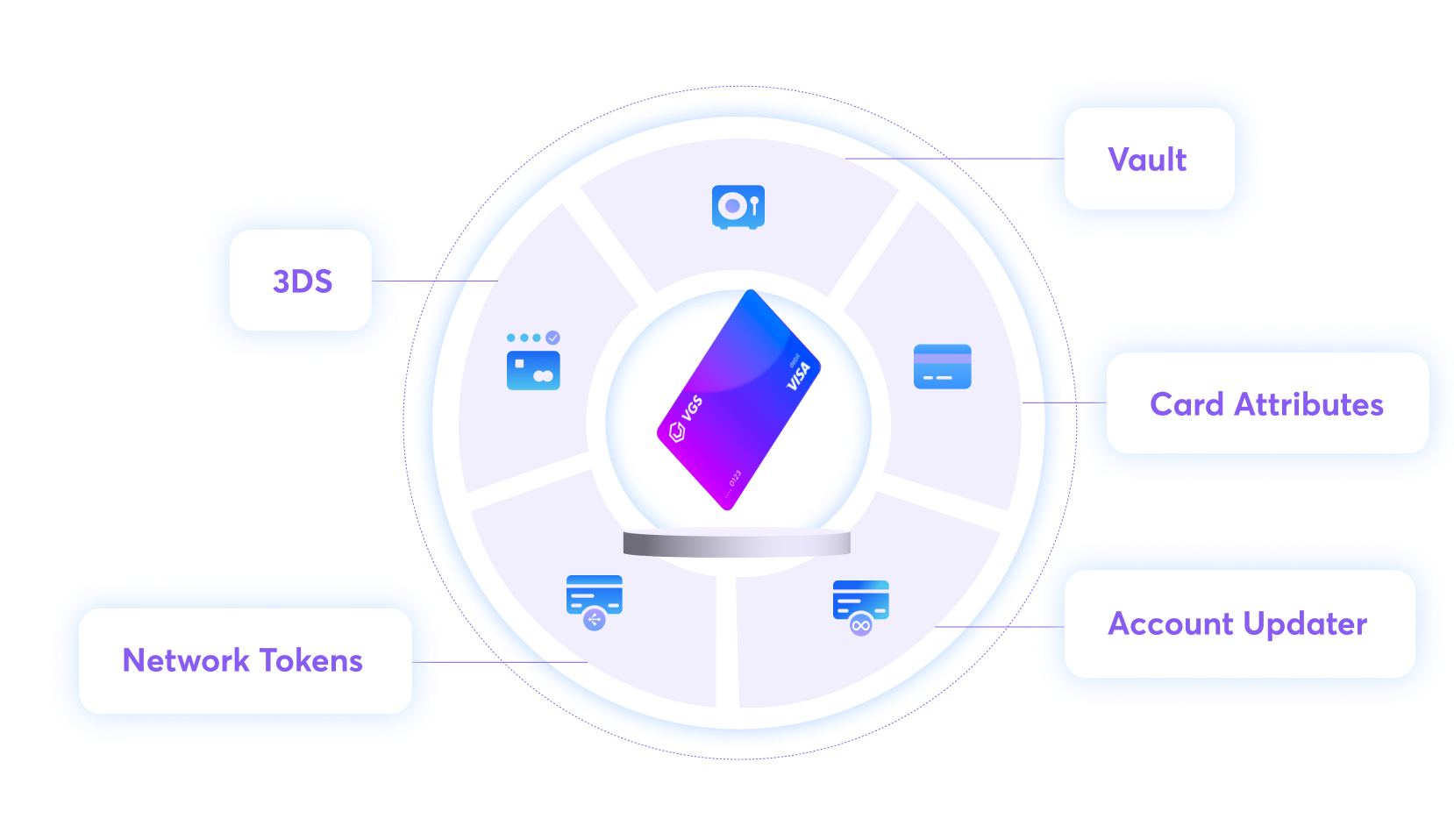

VGS combines multiple capabilities into a single, streamlined integration. With a single connection, you gain access to:

This centralization allows you to decouple from your PSPs and own all your data. Instead of being locked into a provider's ecosystem, you'll experience a unified front-end for card capture and 3DS, all while maintaining oversight of your customers' journey.

Flexibility and Data Ownership

Businesses shouldn't be limited by the platform that performs the initial 3DS authentication. With our solution, you can route any transaction to any PSP independently of the authentication step.

Most importantly, you own the authentication response and the response data, which you can use to enhance risk decision tools for optimal outcomes. This ensures you maintain visibility and control over your risk decisions, without being tied to a third party's infrastructure or restricted by PSP silos.

Control

With two types of 3DS that represent advancements in authentication technology, you can choose which type or both, depending on what is best for your business and geographical needs.

Frictionless

Provides Liability Shift

Standard 3DS 2.0 meets regulatory requirements and prioritizes strong customer authentication and liability shift, the authentication flow comes with possibility of a customer challenge if it is deemed a risky transaction.

3DS Data Only prioritizes a seamless customer experience by relying on rich data exchange to assess risk with no customer challenge, but merchants retain fraud liability.

The best choice depends on a business's specific needs, risk tolerance, and the regulatory environment in which it operates.

We put you in charge of how and when 3DS is executed. You decide the types, rules, and whether you want to run authentication selectively based on customer profiles, geographies, or transaction sizes.

Once the authentication is complete, you can route each transaction to your PSP of choice, guided by your own decision-making logic. That means you won't be forced into rigid flows. VGS gives businesses the ability to optimize for cost, performance, and customer experience.

Why Choose VGS 3DS?

With VGS 3DS solution, businesses no longer need to compromise between security and flexibility. You'll gain:

- A truly provider-agnostic experience provides the power to authenticate flows dynamically, without being tied to a single vendor.

- Built-in compliance as VGS supports across all major card networks (Visa, Mastercard, Amex, Discover, JCB), so you stay compliant across borders.

- One Integration with a unified front-end experience that includes Network Tokens, Account Updates, Card Attributes, Account Verification, and 3DS.

- Reduced latency and risk as the same alias can be reused across 3DS authentication and payment processing, eliminating multiple detokenization events to reduce latency and risk.

- Full control over your routing when you decouple 3DS from your PSP, so you can define custom routing logic.

- A dedicated support team that responds and helps quickly when you need it most.

Ready to take your 3DS strategy to the next level?

Discover how our centralized, flexible, and fully customizable 3DS solution can help you secure transactions while unlocking payment freedom across borders.

Contact Us