“It was amazing how as part of helping us go through the PCI DSS audit, VGS helped implement necessary technical controls in our infrastructure with VGS Vault. It's the first time I've seen someone take this really boring part of compliance and make it very close to engineering first - helping me as an engineer understand and integrate compliance into my landscape.” - Oleg Murasko, VP of Engineering

Once the team decided not to build out PCI infrastructure in-house, they began searching for a solution that would allow them to process payments data securely, without giving up control of their data.

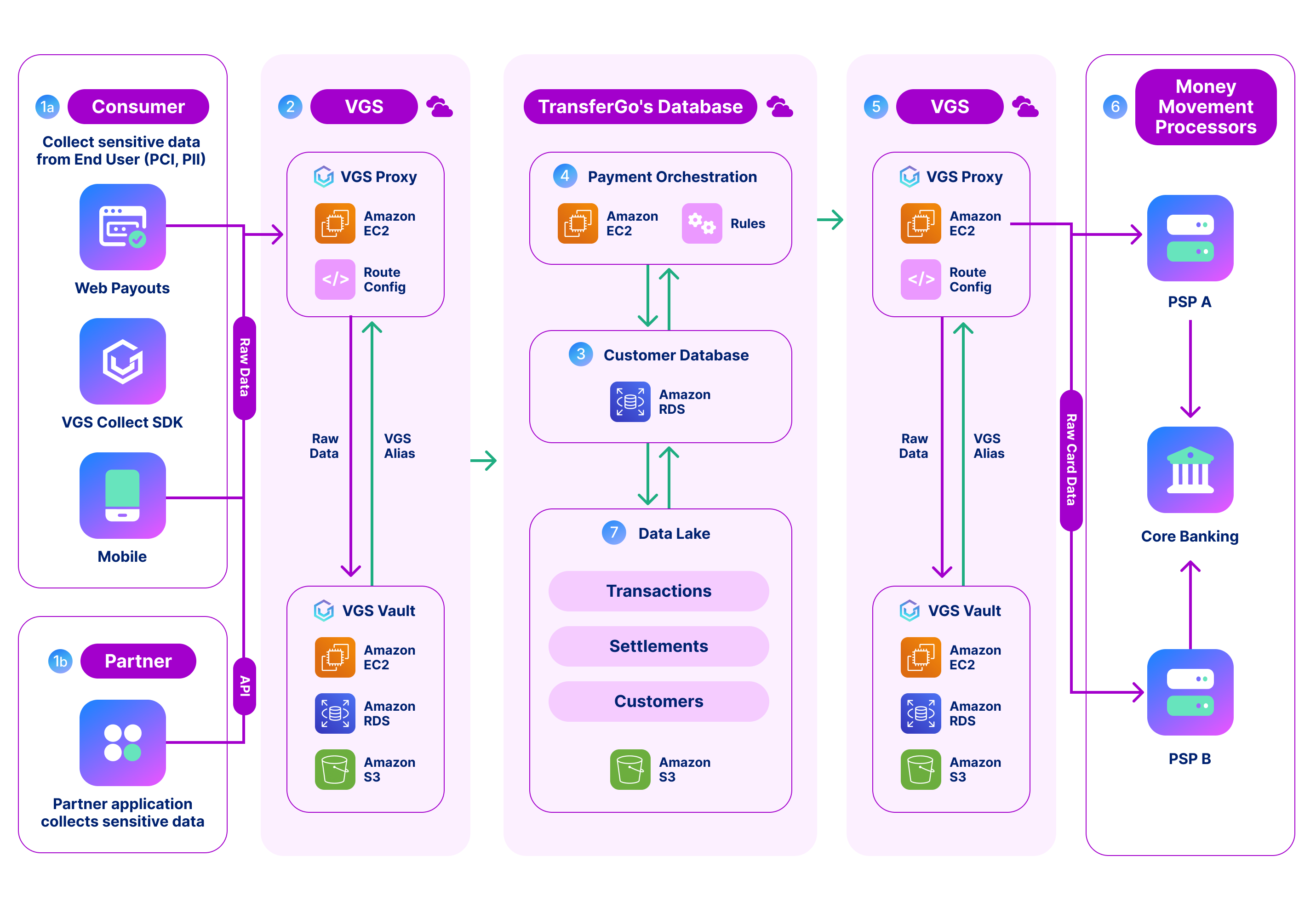

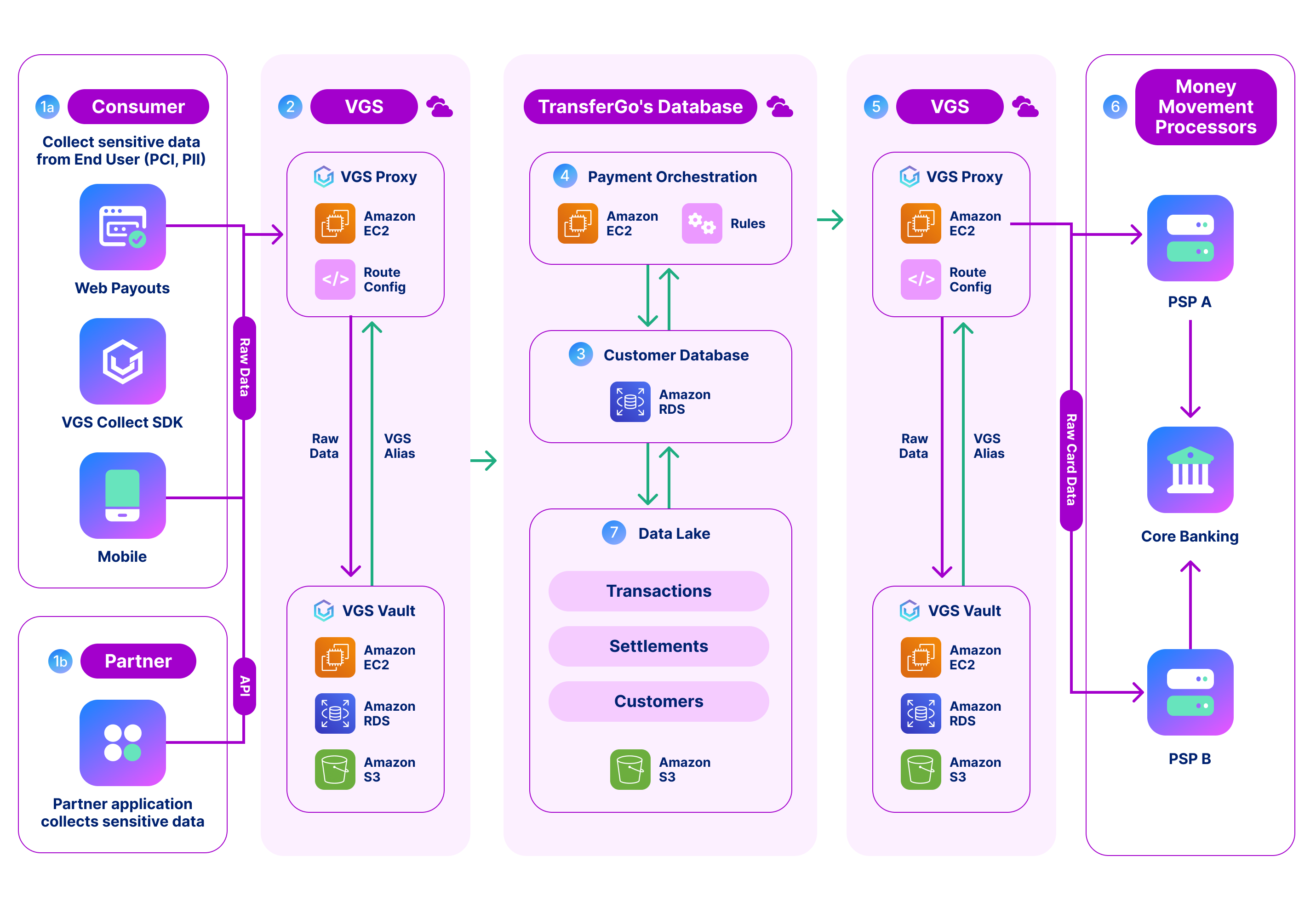

After evaluating several vendors, TransferGo selected Very Good Security to accelerate their PCI DSS Level 1 compliance certification and remove their data security burden. In addition, using VGS allowed their API to work with full card details while insulating their enterprise customers - and TransferGo - from seeing or touching that data.

There were several reasons the team selected VGS over the competition.

Support

Other solutions considered were lacking in support of custom certificates, DPM, and quality of technical support. In comparison, Oleg was impressed with the VGS pilot and subsequent implementation, “VGS provided a better engineering experience and it just worked as we expected. The technical support team was amazing, and that was a really important decision point for us. Our team wasn't sitting around stuck and waiting during integration because of the great turnaround time and the quality of communication. Documentation was also easy to find and understand. Surprisingly other vendors were not shining from a support perspective which was really… I expected a bit better.”

Features & Engineering-focused User Experience

During implementation, Oleg and team found VGS to be extremely flexible. “It is like a set of Lego blocks that are flexible and modular, so you can play around and configure it quickly. Conceptually, it's a small and simple building block that you can use within your existing architecture. We could easily treat it as part of our core infrastructure,” said Oleg. He went on to explain that it has “c-line, better monitoring, proper role-based access. This is what I would expect as an engineer in a service I am buying for my core infrastructure. It's not a black box; this is what I like.”